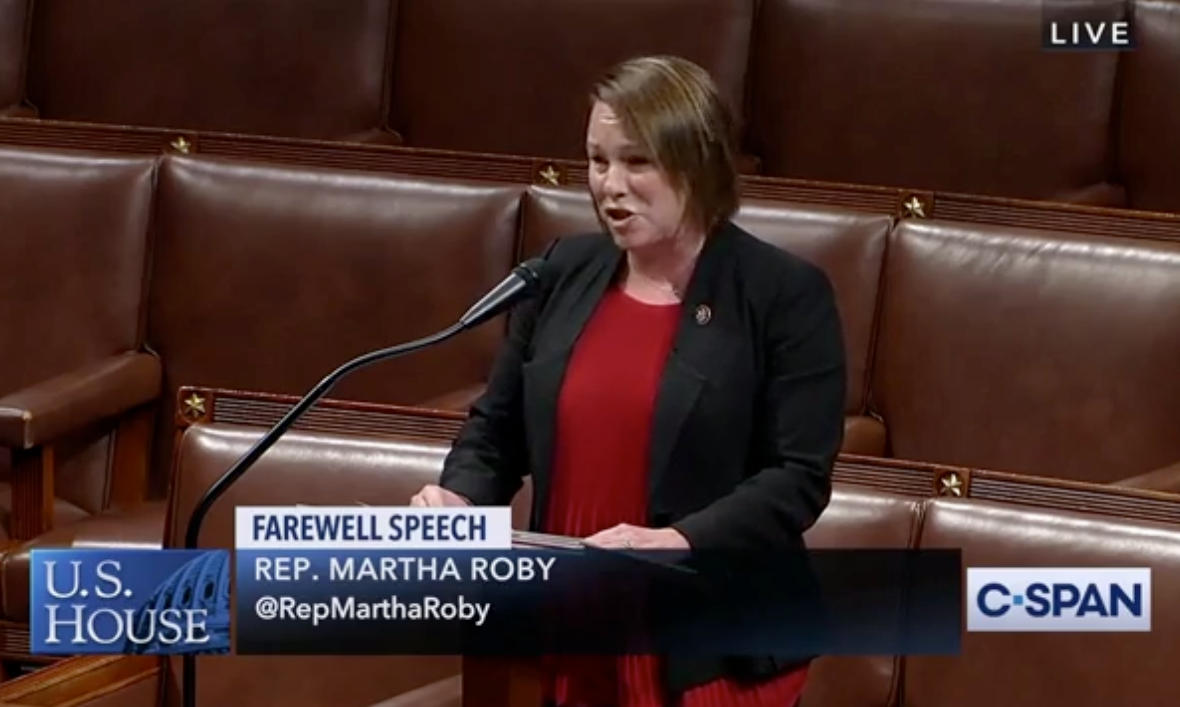

By U. S. Representative Martha Roby (R-AL2)

It’s no secret that college and career-tech expenses have risen dramatically over the last several years. Planning ahead to cover these increased costs has become essential for American families who want their children to have the opportunity to train for the careers of tomorrow.

Millions rely on so-called 529 college savings plans for this purpose. These plans are named for Section 529 of the Internal Revenue Code, which Congress established in the 1990s to set up a tax-free way for families to save for higher education.

Their popularity has only grown since, leading families to open nearly 12 million accounts and accrue savings of more than $225 billion to put toward school.

That’s why it was mind-boggling to hear President Obama in his State of the Union Address propose taking away this tax savings benefit, calling it a “loophole.” Why would we want to make it harder for families to plan ahead and save for their children’s education?

Not surprisingly, the president’s plan to tax 529 college savings plans was roundly criticized by Republicans and Democrats alike, and soon the White House announced they were dropping it.

But, Congress can do more than just protect beneficial 529 plans; we can make them even better. My colleague, Rep. Lynn Jenkins of Kansas has a commonsense plan to do just that.

Her bill, appropriately-numbered H.R. 529, aims to expand and modernize 529 plans making them even more applicable and user-friendly for today’s families. The bill would:

•Allow 529 account funds to pay for students’ computers;

•Remove unnecessary paperwork to help simplify the process for both administrators and those seeking to invest in a 529 plan;

•Permit re-deposit of refunds from colleges back into a 529 account without taxes or penalties, so long as the deposit occurs within 60 days of a student withdrawing from the college.

I’m pleased to report that the bill passed with a strong bipartisan vote of 401-20. Such an overwhelming vote gives me confidence we will also have the support to pass this bill in the Senate.

As a parent, I want nothing more than for all children to have every opportunity to pursue their dreams. Congress should encourage, and not penalize families who want to plan ahead for their children’s education.

I hope President Obama will join our efforts to make higher education more affordable and attainable for families across our nation, instead of looking for more ways to raise taxes.

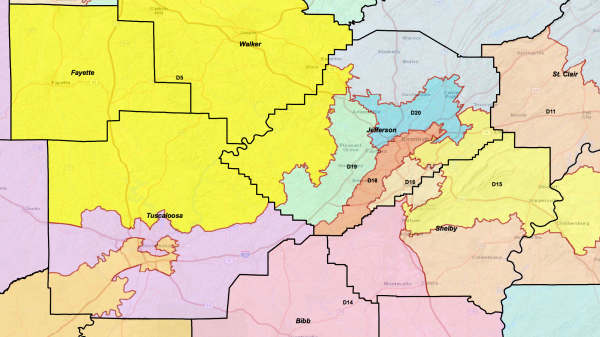

Martha Roby represents Alabama’s 2nd Congressional District. She is currently serving her third term.