By Brandon Moseley

Alabama Political Reporter

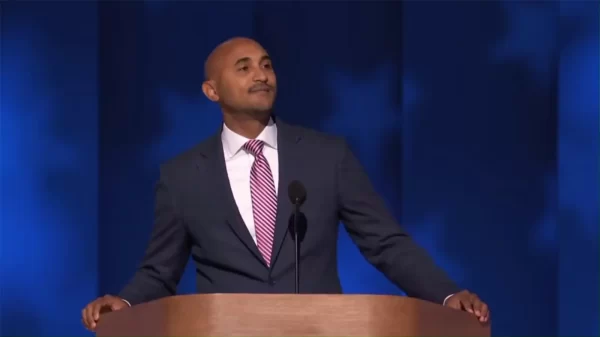

On Tuesday, September 16, the House Judiciary Committee passed a bipartisan financial institutions bankruptcy reform bill that was introduced by Judiciary Chairman Robert Goodlatte (R from Virginia), U.S. Representative Spencer Bachus (R from Vestavia) , and Ranking Member John Conyers (D from Michigan).

The three veteran legislators introduced a joint statement on the legislation following the vote of the committee: “We strongly support the Committee’s passage of the bipartisan Financial Institution Bankruptcy Act today. This bill was carefully calibrated to strengthen our nation’s bankruptcy laws and to ensure that the bankruptcy process is well equipped to resolve companies of all operations and sizes. This legislation enhances the Bankruptcy Code and its ability to resolve financial institutions in an efficient and value-maximizing manner for the benefit of the U.S. and global economies, employees, creditors, and customers.”

According to information provided by U.S. Representative Bachus’s office, the legislation draws on lessons learned from the financial crisis of 2008. Then the existing bankruptcy process was not adequately equipped to deal with the special challenges posed by distressed and failing financial institutions. At that time Rep. Bachus was the Ranking Member on the House Financial Services Committee and played an integral role in deliberations over the federal government’s emergency response to the crisis.

The Financial Institutions Bankruptcy Act of 2014, if ultimately passed by Congress and signed into law by the President, would establish a special process to facilitate an orderly resolution of failing financial firms through the bankruptcy code.

Congressman Bachus is the Chairman of the Judiciary Subcommittee on Regulatory Reform, Commercial and Antitrust Law, which held numerous hearings with experts in bankruptcy law during the development of the legislation.

During the Great Recession of 2008 to 2009 a number of banks, including Alabama based Colonial Bank collapsed in a very short period of time and government regulators were forced to handle the transfer and liquidation of numerous financial institutions all at the same time in the unexpected financial crisis.

Congressman Bachus is retiring at the end of this year after 22 years serving the people of Alabama’s Sixth Congressional District. Representative Bachus’s portrait was recently unveiled at the Capital.

Representative Terri Sewell (D from Selma) said on Facebook, “Congratulations to my friend and colleague Rep. Spencer Bachus on the unveiling of his portrait! He will truly be missed in the halls of Congress.”

The next U.S. Representative will likely be either Republican Gary Palmer or Democrat Mark Lester. Palmer is the longtime President and co-founder of the Alabama Policy Institute. Lester is a former U.S. District Attorney in Arkansas and longtime Birmingham Southern College history professor.