Staff Report

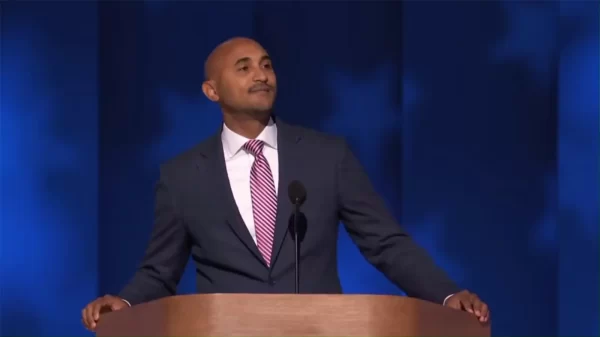

(MONTGOMERY)—Attorney General Luther Strange today announced that he has filed a lawsuit to stop the operation of slot machines at casinos owned by the Poarch Band of Creek Indians.

The lawsuit was filed this morning in the Circuit Court of Elmore County against PCI Gaming Authority and the individual members of the Poarch Band’s Tribal Council and Gaming Authority in their official capacity. Although state police officers cannot enforce state law on Indian lands by executing a warrant to seize unlawful devices, the lawsuit contends that the Poarch Band still has an obligation to comply with state laws that prohibit slot-machine gambling. The lawsuit alleges that the Poarch Band is “operating, advancing, and profiting from unlawful gambling activity at the Creek Casino in Wetumpka, the Wind Creek Casino in Atmore, and the Creek Casino in Montgomery in violation of Article IV, Section 65 of the Alabama Constitution (1901) and Ala. Code § 13A-12-20 et seq.” The lawsuit further alleges that the “continued operation of unlawful gambling devices by Defendants is a public nuisance” that should be enjoined by the court.

Attorney General Strange said that he decided to file the lawsuit after his other efforts to stop the Poarch Tribe’s gambling activities failed and because state officers cannot seize gambling devices on Indian land. “Unlawful gambling is a statewide problem, and I have worked with local authorities to enforce Alabama law consistently and fairly throughout the state,” Strange said. “I have sent two letters to the National Indian Gaming Commission, asking them to stop the Poarch Band’s unlawful gambling, but the Commission has refused to do anything about it. The Commission’s inaction has left me with no choice but to file this lawsuit,” Strange said. Attorney General Strange sent letters to the National Indian Gaming Commission on Feb. 11, 2011, and again on April 25, 2012, which asked the Commission to take action against the Poarch Tribe.

Attorney General Strange noted that the lawsuit is consistent with other actions he has taken with respect to Indian gambling. “I have lobbied Congress to stop the expansion of Indian gambling to new areas, and I have filed a brief in the Alabama Supreme Court to oppose the Poarch Band’s efforts to use its land for gambling,” Strange said. “As I have said many times, my office will use every tool at its disposal to stop illegal gambling in Alabama, wherever it is located. This lawsuit against the Poarch Band is one of those tools.”

In 2012, Congress was considering proposed legislation that would have overruled Carcieri v. Salazar, 555 U.S. 379 (2009), a U.S. Supreme Court decision that limited the Secretary of Interior’s ability to set aside land for Indian tribes to use for gambling. Attorney General Strange requested that Alabama’s Congressional delegation oppose the proposed legislation and co-sponsored a letter from 13 state attorneys general to Congress in opposition to it. Attorney General Strange also filed a brief in the Alabama Supreme Court that asked the Court to apply the Carcieri decision to the Poarch Tribe. The brief was filed in Jerry Rape v. Poarch Band of Creek Indians et al., No. 1111250 (Alabama Supreme Court).