By Brandon Moseley

Alabama Political Reporter

President Barack H. Obama reaffirmed his stance that the nation needs to raise taxes to deal with the approaching fiscal cliff and sequestration crisis in a rare White House press conference.

This time the President doubled the amount of tax increases he was asking for to $1.6 trillion over the next decade. Stocks fell sharply on the news. The Dow Jones industrial average dropped 185 points. Stocks have fallen steadily since American voters reelected President Barack H. Obama and a divided Congress to power on November the 6th. The Dow has fallen 675 points since the election.

On Wednesday, the Dow dropped 185.23 points to 12,570.95 while the S&P 500 slipped 19.04 points, or 1.4 percent, to 1,355.49. The Nasdaq composite was down 37.08 points, or 1.29 percent, to 2,846.81. Stocks are still up on the year though the Dow has fallen 7.6% from its October 5th peak.

President Obama made it clear that he would demand higher tax revenues from Americans making over $250,000. Republicans in Congress oppose this because higher income earners have more disposable income to invest. Taking more money away from those Americans will take investment capital out of the hands of small businessmen and job creators and the private sector economy in general. They argue that raising taxes on small business and investors could worsen the current economic conditions.

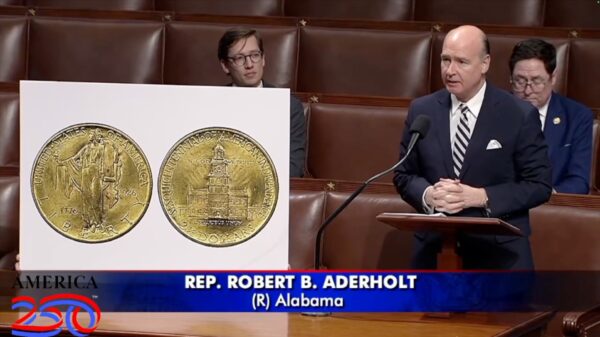

U.S. Representative Robert Aderholt (R) from Haleyville said, “If common ground is going to be achieved, however, it is imperative President Obama understand that members of Congress, regardless of party, cannot abandon the core principles that form the bedrock of their beliefs. For Republicans this means not raising tax rates on families and small businesses in order to pay for more government spending.”

Peter Morici is an economist and professor at the Smith School of Business at the University of Maryland. Morici, writing in the Washington Times warned that the nation’s leaders are flirting with a second Great Depression, “Without new legislation, taxes will be increased and spending cut by more than $600 billion. A sudden and massive drop in private and government spending surely would tank the economy and send the unemployment rate into the teens. All confidence would be lost in Washington’s ability to manage its finances, bondholders would abandon U.S. Treasury-issued bonds, the Federal Reserve would be compelled to print money to finance the government and avert default, and U.S. businesses would flee to more promising and better-managed venues in Asia. A second Great Depression would grip the nation.”

Omaha billion investor Warren Buffet disagrees. According to reporting by Money News, Buffet thinks the nation can go over the fiscal cliff without economic catastrophe. Buffet said, “I lived through the 1950s and 60s with rates far higher for capital gains taxes and corporate taxes, and our economy boomed. Never in 60 years of managing money have I come up with an idea and had someone say ‘I’d do it but the tax rates are too high’.”