By Brandon Moseley

Alabama Political Reporter

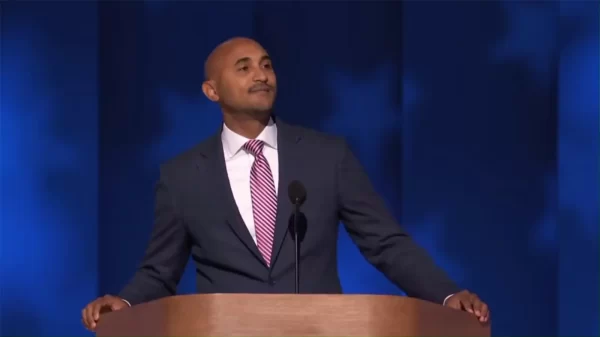

Congressman Spencer Bachus (R) from Vestavia issued a written statement following the Treasury Department’s decision to reduce the dividend rate paid to the Treasury on Senior Preferred Stock of Fannie Mae and Freddie Mac.

Congressman Bachus is the Chairman of the House Financial Services Committee which oversees the banking industry including Freddie Mac and Fannie Mae. Chairman Bachus said, “The Administration took its first step toward GSE reform in nearly four years today. Unfortunately, rather than announcing steps to wind down Fannie Mae and Freddie Mac, the Administration opted to create a permanent, off-budget source of funding for housing that it will control.” Representative Bachus continued, “Eliminating the dividend that is owed to taxpayers irresponsibly benefits speculators and pre-conservatorship GSE stockholders at the expense of the American public. The dividend was designed to guarantee that taxpayers would be fully repaid and that Fannie and Freddie would not be reincorporated after their conservatorship as private companies with public charters and missions. Today’s announcement makes it less likely that taxpayers will ever be paid back for their $200 billion bailout and blunts efforts to reform Fannie and Freddie by fostering the false impression they are healthy institutions that should be restored to their previous status.” Rep. Bachus’s statement said, “Last year, the House Financial Services Committee passed H.R. 2436 by voice vote to codify the September 2008 agreement between the Treasury Department and the GSEs and to ensure that the taxpayers’ investment in Fannie Mae and Freddie Mac will be repaid.”

The two government backed mortgage companies were largely responsible for financing the housing boom of the previous decade. The companies bought mortgages from banks and other lenders and then repackaged those investments as derivatives that they sold to investors all over the world. When rising home prices and risky variable rate mortgages began to reset at higher prices, homeowners were unable to pay their mortgage payments. The resulting mortgage crisis sent shock waves through out the global financial system. The federal government, rather than allowing the two Government Sponsored Enterprises (GSEs) to fail, provided $190 billion in aid (itself entirely borrowed from future taxpayers). The Treasury received an 80% stake in the troubled companies and have been required to pay quarterly dividends amounting to a 10% return on the bailout money. To date, Freddie and Fannie have paid the Treasury just $46 billion.

Under the plan the government would receive all the profits rather than the required 10% return some of which has been paid by more bailout money. The administration claims that the changes in the previous agreement will lead to a quicker wind down of the government’s investment in the two mortgage giants.

Congressman Spencer Bachus represents Alabama’s Sixth Congressional District.