By Brandon Moseley

Alabama Political Reporter

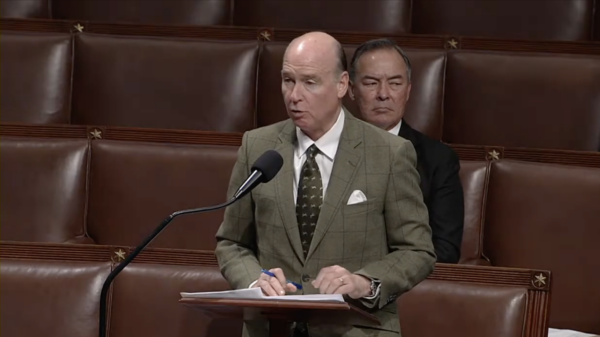

Alabama State Representative Joe Hubbard (D) from Montgomery released a statement announcing that is building bi-partisan support for HB712. HB712 would raise the user fee on cigarettes and ear-mark those additional funds for Medicaid.

Rep. Hubbard said, “You ask taxpayers to pay for the services they use.” “Smoking costs the State hundreds of millions of dollars annually, and it is not right to ask children and seniors to shoulder that burden. That burden should fall to smokers.” “These are voluntary fees. If you don’t want to pay the fee, don’t smoke.” Rep. Hubbard compared his proposal to the State gasoline tax, which pays for upkeep of the Alabama’s roads and bridges.

Rep. Hubbard said that his proposal would generate $220 to $240 million each year, which the bill would appropriate to Medicaid. Hubbard estimates that tobacco-related illnesses cost Alabama taxpayers $238 million in Medicaid expenditures every year. Additionally, the federal government will apply a 2.7-to-1 match on each dollar raised from the cigarette taxes, generating over $880 million annually for Alabaa Medicaid. Rep. Hubbard said that that would balance the Medicaid budget and free up additional money for other agencies in the Alabama General Fund.

Rep. Joe Hubbard said, “When the proposed budget would prioritize the healthcare of convicted felons over that of our children and seniors, a bill that puts the children and seniors back on top of our priority list carries a lot of weight.” “It’s not right to ask the non-smoking citizens of this State to pick up the tab for smokers’ medical bills. This proposal simply asks smokers to pay their own way.”

Sen. Bryan Taylor (R) said, “One thing we all agree on is that smoking-related illnesses are driving up the state’s health care spending every year. Through Medicaid, the taxpayers wind up having to foot the bill to treat health problems caused by a Medicaid patient’s personal decision to indulge in a bad habit.” Hubbard agreed, “It’s not right to ask the non-smoking citizens of this State to pick up the tab for smokers’ medical bills. This proposal simply asks smokers to pay their own way.” Sen. Taylor called Rep. Hubbard’s proposal, “logical.”

Rep. Hubbard said, “I’m pleased that Sen. Taylor recognizes a fiscally responsible government places the burden on those who create the costs.” Rep. Hubbard said his proposal will generate enough money to pay for essential state services, which the proposed budget has cut as much as 40%. Rep. Hubbard called the House budget that passed on April 10 “controversial” and said that the cuts were “draconian.”

Rep. Hubbard’s bill would add a user fee to Alabama’s excise fee on cigarettes, bringing the total fees to $1.42 a pack. The national average state fee on cigarettes is $1.45 per pack. Alabama currently has the fourth highest alcohol fee in the country and the third lowest cigarette fee.

The President of MASA (Medical Association of the State of Alabama), Dr. Jeff Terry, said “Alabama has one of the lowest tax rates per package of cigarettes in the country, yet tobacco use and cigarette smoke greatly increases our state healthcare costs.” MASA predicts that the tax would also save 20,000 lives by preventing premature smoking deaths.

Dr. Terry and Surgeon General of the United States, Dr. Regina Benjamin have both endorsed Rep. Joe Hubbard’s tobacco tax plan. HB712 has also been endorsed by MASA, the American Cancer Society, the American Heart Association, the Alabama Academy of Family Physicians, the Alabama Academy of Pediatric Dentistry, the Alabama Cancer Congress, the Alabama Chapter of the Academy of Pediatrics, Alabama Dental Association, Alabama Hospital Association, Alabama Orthopaedic Association, Alabama Academy of Radiology, Alabama Primary Healthcare Association, Alabama Section ACOG, Alabama Rural Health Association, and the Neurological Society of Alabama.