By Bill Britt

Alabama Political Reporter

MONTGOMERY-One Spot, the acronym for Optional Network Election for Single Point Online Transactions was designed to facilitate a streamline statewide electronic filling and remittance system for sales, use, land and retail taxes in Alabama.

The electronic filling system was a part of the “President Pro Tem’s Initiative to Streamline Government and House Speaker’s Commission on Job Creation,” recommendations.

The bill, was sponsored in the Senate by Senator Slade Blackwell (R- Birmingham).

“It is a cool bill,” said Blackwell. He explains that in the State Senate there are very few instances when a bill is really innovative.

“What this bill does is brings us into the electronic age. Now a business can go on line and file their taxes electronically, said Blackwell.

Single Point Online Transactions, will be administered by the Alabama Department of Revenue and available for use by both taxpayers and Alabama municipalities and counties at no cost. The bill requires the system to be operational in time for returns and payments due in tax periods that begin after Sept. 30, 2013.

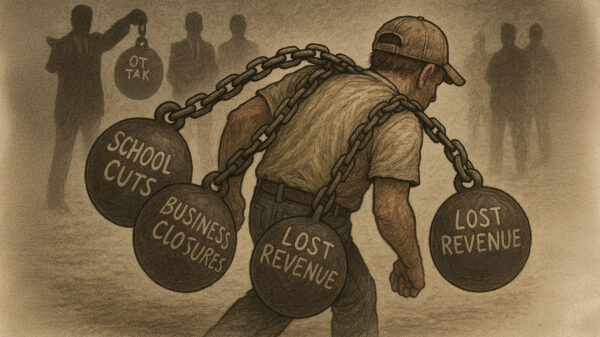

According to the bill’s supporters the passage of the bill will end an administrative nightmare for companies around the state.

It has been shown that the state has retailers who file over one hundred filings a month writing up to 150 checks to 150 different agencies.

“This eliminates a lot of red tape and streamlines the entire process,” said Blackwell,

“This is a real convenience for small businesses in Alabama.”

The system is optional for taxpayers who may wish to continue filing their taxes using the old method. The bill seeks to provide a more efficient method for business that can lead to greater productivity with fewer government burdens.

Senator Marsh said this legislation is a giant step toward streamlining the way businesses interface with state and local government.

“It is a tremendous administrative burden on businesses to have to file what could be hundreds of separate tax returns with cities and counties across the state,” Marsh said. “This common sense solution to alleviate that burden and is a perfect example of how we can streamline government operations to better serve Alabama taxpayers.”

Working to eliminate government red tape will promote growth in Alabama’s private sector economy, Speaker Hubbard said.

“When we travelled the state asking business owners what was hindering them from growing their businesses and hiring more workers, almost everyone pointed to bureaucratic red tape. The layered system businesses have to navigate for filing city and state taxes defines red tape, and it’s about time we did something about it. I’m proud to work together with Senate President Pro Tem Marsh and the bill sponsors on a common sense reform that will boost job growth and make government more efficient all that the same time. We look forward to passing this legislation in the House.”

Senator Blackwell said members of the business community have been calling for this reform for years and could be one of the most important pro-business bills passed this session.

“This bill could be one of the most important, pro-business items of legislation that the Legislature passes this year,” Blackwell said. “Small businesses have been pushing for this reform for years and I’m proud to sponsor this bill that will make the filing process more efficient.”