Staff Report

From the Office of Senator Trip Pittman

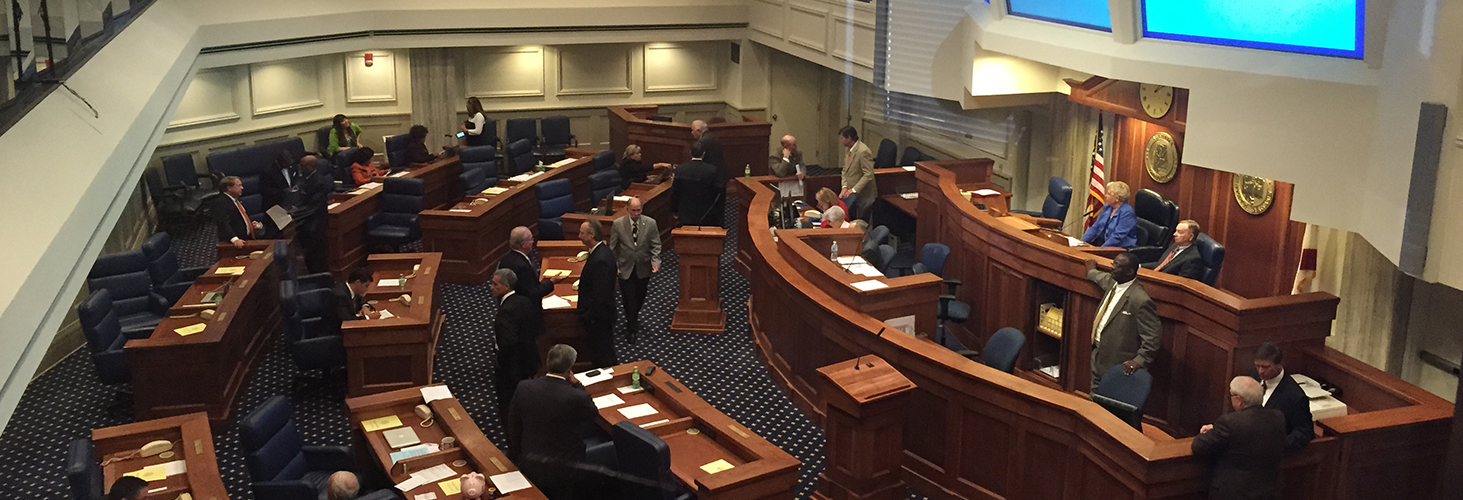

MONTGOMERY – The Alabama Senate passed a bill late Thursday evening that will expand the scope of certain tax incentives in order to focus on recruiting data processing centers to the state.

The Alabama Data Processing Center Economic Incentive Enhancement Act, House Bill 154 sponsored by Representative Dan Williams (R-Athens), extends the period of time that granting authorities can abate certain ad valorem taxes and construction-related taxes for data processing centers and warehousing and storage facilities in Alabama.

Senator Trip Pittman (R-Montrose), who handled the legislation in the Senate, said data processing centers are key components of the 21st century economy.

“With this proposal, we will be adding yet another tool to help us recruit new jobs and retain existing business in the state – resulting in more jobs for Alabamians,” Senator Pittman said. “We will continue working to identify innovative solutions – like this data processing bill – to make sure we are promoting a pro-growth business climate and building a solid economic environment for the future of our state’s citizens.”

“Alabama’s economy is improving, which is reducing unemployment,” Senator Pittman added. “But there are still too many people without jobs. Our main focus is to help the state’s economy grow and put people back to work. Any legislation that assists increased economic activity will remain a top priority.”

Representative Williams thanked Senator Pittman for working to pass this bill in the Senate and said the legislation could add a whole new dimension to Alabama’s economic development efforts.

“Alabama has an opportunity to tap into a growing industry that could contribute to significant job growth,” Representative Williams said. “Data centers provide good-paying jobs and have a low environmental footprint. There’s no reason why we shouldn’t be competing for those jobs.”