By Susan Britt

Alabama Political Reporter

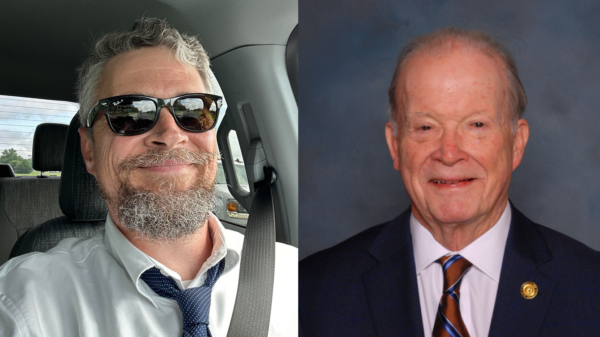

A bill to further increase tax incentives to the entertainment industry was introduced to Senate Finance and Taxation, Education Committee on Wednesday during a public hearing by Representative Terri Collins (R-Decatur,)the Senate companion bill, SB290, is sponsored by Gerald Dial (R-Lineville).

HB 243 seeks to increase the tax incentives of the 2009 Alabama Entertainment Act, initially aimed at the film industry. The 2009 bill set a structure of tax incentives and caps through 2011 with the final amount for years going forward set at $10 million. The new bill would raise the incentive to $20 million through 2014 and $25 million thereafter. It will also include music tracks and music videos as participants in the program.

In 2011, Alabama set the backdrop for production companies who spent approximately $22.5 million and were reimbursed $5.6 million in incentives, according to the Alabama Film Office (AFO).

In the first quarter of 2012, an estimated $6 million is already committed for film production showing that the $10 million cap will be reached before year’s end says AFO.

“We hope the legislature will agree to increase our incentives and pass HB243 so that we will see more production and continue to build the crew base necessary to support this industry,” says Alabama Film Manager Kathy Faulk.

As a result of the 2009 Act, “A Smile as Big as the Moon,” was filmed at the U.S. Space & Rocket Center in Huntsville.

A 2010 amendment to the Act added televisions series to the films resulting in numerous reality shows locating in Alabama. They include Country Music Television (CMT) series “Sweet Home Alabama” which is currently airing its third season, History Channel’s “Big Shrimpin’” filmed along the Gulf Coast, and “Rocket City Rednecks” in the Decatur and Huntsville areas.

The Alabama Film Office estimated the incentive offers, rebate amounts and overall economic impact to the three areas effected by the 2009/2010 bill as follows:

Mobile County: Mudbrick Media Procuctions; 4 feature films; estimated Alabama budget $19,639,000; rebated amount $5,527,000; overall economic impact $68,738,000.

Baldwin County, Fairhop: “Sweet Home Alabama;” 3 seasons/8 episodes; estimated Alabama budget $7,018,000; rebated amount $1,962,000; overall economic impact $24,565,000.

Madison County, Huntsville: “A Smile as Big as the Moon;” estimated Alabama budget $2,351,000; rebated amount $595,000; overall economic impact $8,231,000.

The bill, as changed, reads:

“The rebate shall be equal to 25 percent of the state-certified production’s production expenditures excluding payroll paid to residents of Alabama plus 35 percent of all payroll paid to residents of Alabama for the state-certified production, provided the total production expenditures for a project must equal or exceed at least five hundred thousand dollars ($500,000), but no rebate shall be available for production expenditures incurred after the first ten twenty million dollars ($20,000,000) of production expenditures expended in Alabama on a state-certified production.”

Music tracks, now included as part of the incentive package, can receive rebates for production expenditures of at least $50,000 but not more than $300,000 of the project investment.

Music videos, also included, must invest a minimum $50,000 and can claim rebates up to but not to exceed $300,000.

Rebates can be applied to offset any income tax liability. They will also include any payment of the state portion of sales, use and lodging taxes on production expenditures and also caps out at $20 million.

With the fiscal year remaining from September 31 through September 30 for all qualified production companies, the bill structures the incentives as follows:

2009–$5 million

2010–$7.5 million

2011–$10 million

2012–$10 million

2013–$15 million

2014–$20 million

Thereafter–$25 million

Chairman Trip Pittman (R-Daphne) was assured that all persons employed by the jobs created in this bill would require an Alabama driver’s license.

The Finance and Taxation, Education Committee heard but did not vote on the bill today. The vote is anticipated to be scheduled for next week.