Staff Report

Alabama Political Reporter

State share of national settlement estimated at $106,701,096

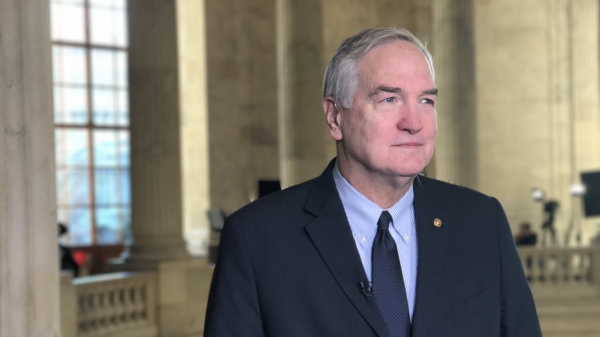

From the Office of Attorney General Luther Strange

(MONTGOMERY)–Attorney General Luther Strange Thursday formally joined a landmark $25 billion national joint federal-state agreement with the nation’s five largest mortgage servicers over foreclosure abuses and fraud, and unacceptable nationwide mortgage servicing practices.

The proposed agreement provides an estimated $ 106,701,096 in direct relief to Alabama homeowners and addresses future mortgage loan servicing practices. U.S. Attorney General Eric Holder, U.S. Housing and Urban Development (HUD) Secretary Shaun Donovan and a bipartisan group of state attorneys general announced the settlement in Washington, D.C.

“This agreement not only provides much needed relief to Alabama borrowers, but it also puts a stop to many of the bad behaviors that contributed to the mortgage mess in our state and across the country,” said Attorney General Strange.

The state’s estimated share of the settlement is $106,701,096.

•Alabama’s borrowers will receive an estimated $29,879,070 in benefits from loan term changes and other relief.

•Alabama’s borrowers who lost their home to foreclosure from January 1, 2008 through December 31, 2011, and encountered servicing abuse would qualify for $20,595,756 in payments to borrowers.

•The value of refinanced loans to Alabama’s underwater borrowers would be an estimated $29,751,516.

•The state will receive a direct payment of $26,474,753 directed to the Attorney General’s Office.

The unprecedented joint state-federal settlement is the result of a massive civil law enforcement investigation and initiative that includes state attorneys general and state banking regulators across the country, and nearly a dozen federal agencies. The settlement holds banks accountable for past fraud and abuses and provides relief to homeowners. With the backing of a federal court order and the oversight of an independent monitor, the settlement stops future fraud and abuse.

Under the agreement, the five servicers have agreed to a $25 billion penalty under a joint state-national settlement structure.

Nationally:

•Servicers commit a minimum of $17 billion directly to borrowers through a series of national homeowner relief effort options. Servicers will likely provide up to an estimated $32 billion in direct homeowner relief.

•Servicers commit $3 billion to an underwater mortgage refinancing program.

•Servicers pay $5 billion to the states and federal government ($4.25 billion to the states and $750 million to the federal government).

•Homeowners receive comprehensive new protections from new mortgage loan servicing and foreclosure standards.

•An independent monitor will ensure mortgage servicer compliance.

•States can pursue civil claims outside of the agreement including securitization claims as well as criminal cases.

•Borrowers and investors can pursue individual, institutional or class action cases regardless of agreement.

The settlement does not grant any immunity from criminal offenses and will not affect criminal prosecutions. The agreement does not prevent homeowners or investors from pursuing individual, institutional or class action civil cases against the five servicers. The pact also enables state attorneys general and federal agencies to investigate and pursue other aspects of the mortgage crisis, including securities cases.

Scope of Settlement

This enforcement action targets one segment of the nation’s vast and complex mortgage market, though the new servicing standards will apply to all mortgage loans serviced by the settling banks.

“While this settlement includes significant relief for homeowners, it also puts in place new protections for homeowners in the form of mortgage servicing standards,” said Attorney General Strange.

The final agreement, through a consent judgment, will be filed later in U.S. District Court in Washington, D.C., and will have the authority of a court order.

Because of the complexity of the mortgage market and this agreement, which will span a three year period, borrowers in some cases may be contacted directly by one of the five included mortgage servicers regarding loan modification offers, may be contacted by a settlement administrator or their state attorney general, or may need to contact their mortgage servicer to obtain more information about specific programs and whether their loan qualifies. More information will be made available as the settlement programs are implemented.

For more information on the proposed agreement:

www.NationalMortgageSettlement.com

www.HUD.gov

www.DOJ.gov